[ad_1]

Join our Telegram channel to stay up to date on breaking news coverage

Amid growing tensions in the middle East, Bitcoin saw its biggest drop in a year, falling 7.7% on Saturday. Along with Ether, Solana and Dogecoin, the largest cryptocurrency, suffered losses as Iran’s retaliatory attacks against Israel further escalated tensions.

The current situation also affected traditional assets. Stocks fell while safe havens like bonds and the dollar gained ground. Cryptocurrency selloffs intensified over the weekend, sparking one of the largest two-day selloffs in at least six months.

Today’s Biggest Cryptocurrency Gainers: Top List

Unlike previous days, today’s market shows a lot of favorable price movements. 91% of cryptocurrencies have experienced gains in the last 24 hours, while only 9% have experienced losses. However, in the midst of this, it is crucial to look beyond short-term victories. Factors such as innovative project features, collaborations and long-term viability are essential for making sound investment decisions. Our four best winners Today they embody these outstanding characteristics and more. Let’s analyze each one to discover its potential for sustained growth and profitability.

1. Quantity (QTUM)

Qtum, a proof-of-stake (PoS) blockchain, combines the strength of Bitcoin with the versatility of Ethereum. Addresses smart contract interoperability, governance, and integration challenges. Qtum’s account abstraction layer combines Bitcoin’s UTXO model with Ethereum smart contracts. This facilitates the smooth development of applications on multiple virtual machines. The Decentralized Governance Protocol allows network parameter adjustments without forks, promoting agile evolution.

Additionally, this technology accommodates decentralized finance (DeFi), mobile applications, and cross-chain compatibility. With its ability to execute smart contracts within unspent transactions, it aims for decentralized mobile application empowerment and blockchain integration. Spearheaded by the Qtum Foundation, the project gains support from major Chinese investors and collaborates with entities such as PwC to encourage blockchain adoption.

Qtum is committed to empowering developers and maximizing the potential of its tools. As Qtum continues to innovate in the blockchain space, the community can expect updates on the progress of these developments.

➡️ https://t.co/4oQ0y8cbFI

➡️ https://t.co/oAwNZmWUha

➡️…-Qtum (@qtum) April 13, 2024

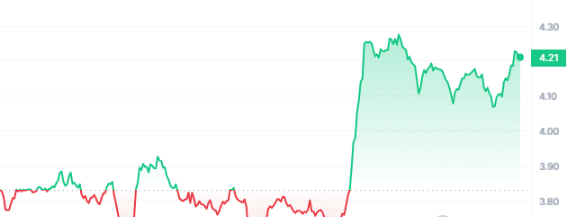

The current price of QTUM is $4.21, which is a notable increase of 9.88% in the last 24 hours. With a market dominance of 0.02%, it showed an increase of 24% over the past year and was trading 18.44% above the 200-day SMA at $3.56. The 14-day RSI of 39.37 suggests a neutral stance, while 53% positive trading days in the last 30 days indicate stability. Its 30-day volatility remains low, at 7%, which guarantees a stable market. Additionally, it is highly liquid with a volume-to-market cap ratio of 0.4231, backed by a market cap of $442.12 million and a 24-hour volume of $187.08 million. Potential investors should carefully evaluate Qtum’s metrics against their investment objectives to accurately measure its profitability.

2. Orbler (ORBR)

Moving from the vibrant world of Web2 to the decentralized realms of Web3, Orbler emerges as a dynamic marketing platform. ORBR, its native utility token, serves as its driving force, propelling Orbler’s innovative efforts forward. ORBR opens the doors to exclusive features, premium insights, and custom tools on the Orbler Web3 marketing platform. Holders earn additional ORBR tokens by staking across multiple pools, powering community-driven growth strategies.

Orbler’s mission platform encourages participation through interactive tasks, while its social media booster amplifies the Web3 project’s presence. The platform prioritizes community building and offers tools for collaboration and adventure-driven interactions. Seamlessly integrated into the Web3 ecosystem, Orbler provides solid support for projects and users.

We are excited to announce our partnership with @SRCAI_official, pioneering AI-powered Web3 app that rewards routine driving data. 🚀 With @Orbler1We’re accelerating innovation to improve driving experiences and revolutionize rewards on the road!#AI #web3 #BTC pic.twitter.com/2zC1hqhprm

-Orbler (@Orbler1) April 11, 2024

Despite recent price fluctuations, Orbler demonstrates tenacity with a 14.93% increase in the last 24 hours. However, its price has declined by 82% over the past year, trading significantly below the 200-day SMA. ORBR’s 30-day volatility is 26%, reflecting manageable fluctuations. Meanwhile, a neutral RSI suggests a possible sideways move, accompanied by a modest 47% positive trading days over the past month. Considering its relatively low liquidity, a cautious assessment of Orbler’s potential against market dynamics is prudent.

3. Sponge V2 (SPONGE)

Sponge V2, the sequel to the widely praised Sponge meme coin, has garnered significant investor interest. It mirrors its predecessor’s impressive 100x earnings in 2023. With a total stake and bridge value of $18 million, Sponge V2 offers attractive rewards. It has annualized rates that exceed 166% on Ethereum and 364% on Polygon. These lucrative incentives have boosted investor participation, driving project growth.

We are on high humidity alert this week 🚨 $SPONGE #SpongeV2 #100x #alternatives pic.twitter.com/Uo0gq0E28y

— $SPONGE (@spongeoneth) April 15, 2024

The project’s thriving community engagement is evident, with over 9 billion tokens staked in its dApp. Sponge V2 prioritizes transparency and legitimacy. This is evident through its strategic partnerships and listings on reputable exchanges such as Uniswap, Poloniex, Toobit, MEXC, and Gate.io. Looking ahead, Sponge V2 plans to list on broader exchanges, improving accessibility and visibility in the cryptosphere.

Besides, Sponge V2 aims to challenge conventional criticism leveled at meme coins by introducing the innovative Sponge Play-to-Earn Racer game. The project seeks to expand its audience by fusing gaming elements with cryptocurrency rewards. This approach provides added value to token holders, potentially driving greater demand and ensuring their long-lasting sustainability.

4. Ontology (ONT)

Ontology is a project focused on improving trust, privacy and security on Web3 through decentralized identity and data solutions. The goal is to offer a cost-effective, high-speed public blockchain that ensures reliable access to Web3 while emphasizing user privacy and compliance with regulatory standards. The project provides a variety of real-life use cases, allowing companies to build custom blockchains on top of Ontology infrastructure.

What sets Ontology apart is its commitment to interoperability and user experience. Support for three virtual machines and tools like ONTO Wallet and ONT ID ensure seamless cross-chain access and put Web3 directly in the hands of users. By simplifying data registration and management processes, Ontology improves the overall user experience and encourages broader adoption of blockchain technology.

🍾As we celebrate another year of @LetsExchange_iowe want to provide @OntologyRed for being our lighthouse in the misty seas of cryptocurrencies. His guidance and support have been invaluable.

🌊 Here’s to navigating the future charting new territories together!#LetsExchangeTurns3,… pic.twitter.com/8waeVuCdQO

– LetsExchange (@letsexchange_io) April 12, 2024

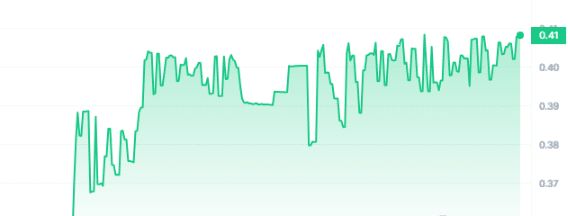

Investors may find Ontology’s performance metrics intriguing. ONT demonstrates bullish momentum with a 16.39% increase in the last 24 hours and a 7% increase over the past year. It appears stable in the short term as it trades 27.74% above the 200-day SMA, with the 14-day RSI indicating neutrality. Additionally, its 30-day volatility of 8% and high liquidity suggest a favorable investment environment, with potential for steady growth and reduced risk.

5. GMX (GMX)

GMX is a decentralized exchange (DEX) that offers perpetual cryptocurrency futures trading with up to 50x leverage on popular assets like BTC and ETH. Launched as Gambit Exchange in September 2021, GMX has amassed a total trading volume of over $130 billion. It has also attracted a user base of 283,000, positioning itself as the leading derivatives DEX on the Arbitrum and Avalanche blockchains.

What sets GMX apart is its utilization of an innovative automated market model (AMM), as opposed to the order book system commonly employed by centralized exchanges. Through its native multi-asset pool, GLP, GMX rewards liquidity providers with a portion of the fees generated. In this process, liquidity providers enjoy a portion of the fees generated without risk of temporary loss. This model, along with the platform’s integration with Chainlink oracles for accurate market pricing, ensures efficiency and fairness in trading.

GMX recently concluded its Arbitrum STIP campaign and it is time to evaluate its success. Did the protocol effectively transform GMX v2 into a fundamental DeFi infrastructure for @Decision..?

Part 2: Business Incentives

In summary, the STIP campaign aimed to:

🔹 Promote… pic.twitter.com/W1qRm1r1Tw

– GMX 🫐 (@GMX_IO) April 12, 2024

GMX has seen a notable increase of 10.22% in the last 24 hours alone. However, it is worth noting that its price has seen a significant decline of 68% over the past year, currently trading well below the 200-day SMA at –42.20%. Despite this, with a 14-day RSI indicating neutrality at 43.83, GMX’s 30-day volatility of 12% coupled with its high liquidity still attracts strategic investors. However, navigating market conditions carefully remains crucial to maximizing opportunities.

Read more

99Bitcoins (99BTC) – New token to learn how to earn

- Audited by solid evidence

- Established brand: founded in 2013

- Free Airdrop – Win a Share of $99,999

- Learn to Earn: Earn money to complete trading courses

- More than 700,000 YouTube communities

Join our Telegram channel to stay up to date on breaking news coverage

[ad_2]